Welcome! Before we begin, I’d like to ask—how confident are you in your Tally Prime and accounting skills?

Are you ready? Let's answer the Quick Questions

Q:1 How do you correct a wrongly filed GSTR-3B in Tally without violating GST laws?

Q:2 What steps would you take to fix a TDS mismatch between Tally and Form 26AS?

Q:3 How can you generate a single consolidated balance sheet from multiple Tally databases without syncing errors?

Q:4 What causes negative closing stock in Tally, and how do you fix it without manipulating entries?

Q:5 What is the best way to fix incorrect cost center allocations in Tally without violating accounting standards?

Q:6 What would you do if Tally suddenly crashed and your last backup is outdated?

Watch the below video to get amswers of these questions

Master Tally Prime 6.0 Like a Pro! Unlock Advanced Accounting Skills, Save Time, and Boost Your Career with Our Step-by-Step Advanced Tally Prime 6.0 Course.

Struggling with complex accounting tasks? Our Tally Prime Advanced Course simplifies everything—from GST filing to inventory management—so you can work faster,

smarter, and error-free."

Why Learn Tally Prime?

Tally Prime is an essential tool for accountants, business owners, and finance professionals. Here's why you should master it:

✅ Manage accounts effortlessly

✅ Generate GST-compliant invoices

✅ Simplify financial reporting

✅ Track inventory & business transactions

✅ Boost your career with professional skills

What You’ll Learn in This Course?

Our structured modules cover everything from fundamentals to advanced techniques.

Basic Accounting

You will learn about basic accounting, which includes. It will help you to understand in depth while working in Tally Prime

Introduction to Tally Prime

You will learn about basic accounting, which includes. It will help you to understand in depth while working in Tally Prime

Company Setup in Tally

Create, modify, and configure company settings, security features, and user management for secure and customized operations.

Accounting Fundamentals in Tally

Master ledger creation, voucher entries, bank reconciliation, and essential accounting processes for accurate financial management.

Inventory Management

Manage stock items, categories, valuation, and godowns efficiently for better inventory control and reporting.

GST & Taxation in Tally

Configure GST, create tax ledgers, file returns, and handle TDS/TCS compliance for tax-efficient business operations.

Payroll & Employee Management

Set up payroll, employee records, salary structures, and statutory compliance for seamless payroll processing.

Financial Reports & Analysis

Generate and analyze balance sheets, profit & loss, cash flow, and trial balance for informed decision-making.

Advanced Features

Utilize cost centers, budgets, multi-currency transactions, and scenario management for advanced financial control.

Banking & Automation

Perform bank reconciliations, e-payments, and automated transactions to streamline banking operations in Tally.

Tally Prime Customization & Shorcuts

Customize reports and dashboards and use shortcuts to improve efficiency and productivity in daily tasks.

Tally Prime with Business Use Cases

Apply Tally Prime in retail, manufacturing, and service industries for real-world business accounting solutions.

Is This Course Right for You?

This course is designed for:

Business Owners & Entrepreneurs

Simplify your business finances with Tally Prime. Manage GST, inventory, and cash flow effortlessly—no accounting background needed. Make smarter decisions with real-time insights and reports.

Accountants & Finance Professionals

Master Tally Prime and boost your billing, GST, and reporting efficiency. Whether you're managing clients or companies, stay ahead with the most in-demand accounting software in India.

Students & Graduates

Get job-ready with Tally Prime skills! Learn practical accounting, GST, and payroll management. Stand out in interviews and add a powerful skill to your resume.

Working Professionals Seeking Career Growth

Upgrade your career with Tally Prime expertise. Add real-world accounting, GST, and MIS reporting skills to your profile and unlock new growth and promotion opportunities.

Freelancers & Independent BookKeepers

Take control of your bookkeeping business! Learn to manage multiple clients, handle GST, and deliver accurate reports using Tally Prime—all from your home office.

Anyone Interested in Accounting & Finance

Curious about accounting? Start here. Tally Prime makes it easy to understand business finances, taxes, and records—even if you’re a complete beginner.

Get exclusive access to these FREE bonuses!

Along with the core lessons, you’ll receive these additional benefits:

Bonus #1

Tally Prime 6.0 Licence for 3 Months

Get hands-on with a fully functional Tally Prime 6.0 license for 3 months—no need to buy it separately! Practice like a pro with real tools.

₹ 4,580/- Worth Bonuses

Bonus #2

Certificate

Receive a professional certificate upon completing the course—boost your resume, LinkedIn profile, and career credibility.

₹ Unlimited/- Worth Bonuses

Bonus #3

Practice Material

Download specially designed practice files and exercises to sharpen your skills and master real-world accounting tasks.

₹ 15,590/- Worth Bonuses

Bonus #4

Balance Sheet Formats

Get access to pre-made, professional balance sheet formats you can instantly use for clients or business reporting.

₹ 10,550/- Worth Bonuses

Bonus #5

Advance Excel & Google Sheets Course

Master formulas, dashboards, and data management with our bonus Excel & Google Sheets course—an essential skill for every finance professional.

₹ 7,590/- Worth Bonuses

Bonus #6

Facebook Community Access

Join an exclusive community of learners, accountants, and business owners. Share, discuss, and grow together—24/7 support and learning.

₹ Unlimited/- Worth Bonuses

Bonus #7

5-Minute, 15 Query Resolve Call in a Every Month

Got quick doubts? Get them solved fast! Book 5-minute calls every month—up to 15 queries resolved by our experts.

₹ Unlimited/- Worth Bonuses

Bonus #8

30-Minute, 2 Calls Query Resolve in a Every Month

Need in-depth help? Book two 30-minute 1-on-1 support calls every month and get expert guidance for your queries or projects.

₹ Unlimited/- Worth Bonuses

Bonus #9

Personnel WhatsApp

Connect directly via WhatsApp for fast query resolution, learning support, and updates—like having a mentor in your pocket.

₹ Unlimited/- Worth Bonuses

Bonus #10

Lifetime Weekly Q & A Session

Join live Q&A sessions every week—forever! Get your questions answered, stay updated, and never stop growing.

₹ Unlimited/- Worth Bonuses

Total Value: ₹ 38,310/-

Today's special discount offer 🎁

Now Only @ ₹ 10,550/-

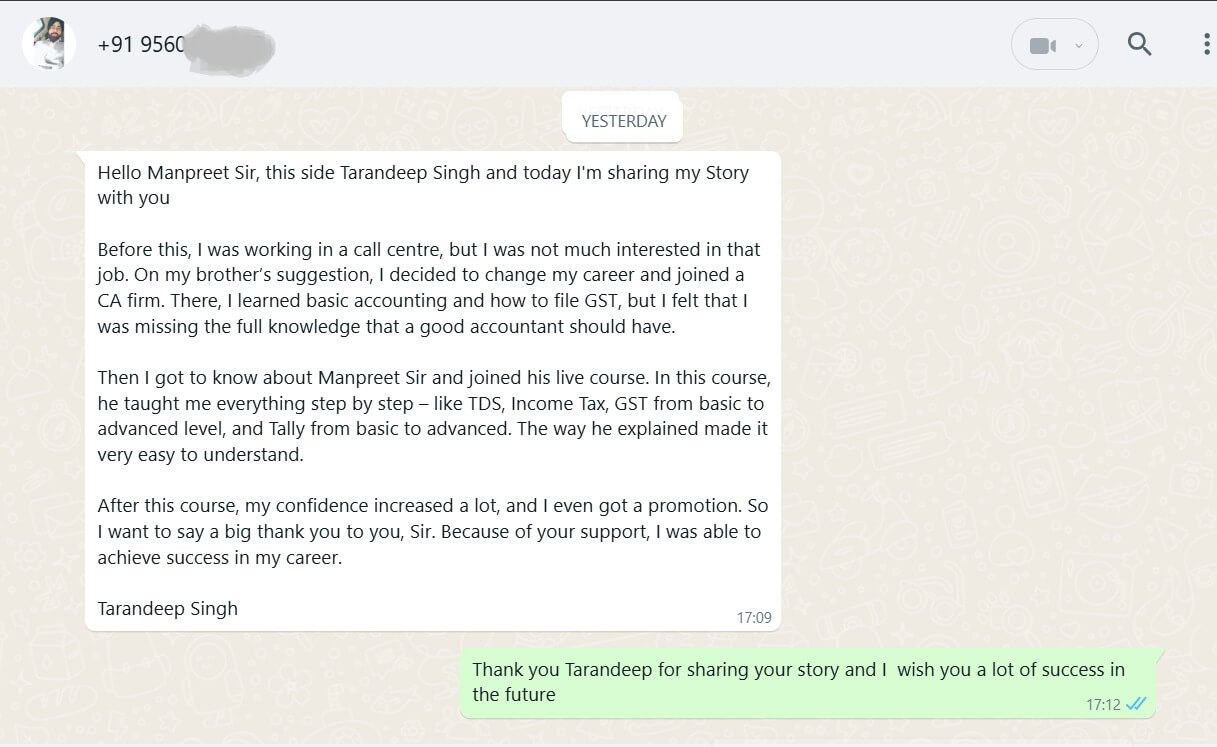

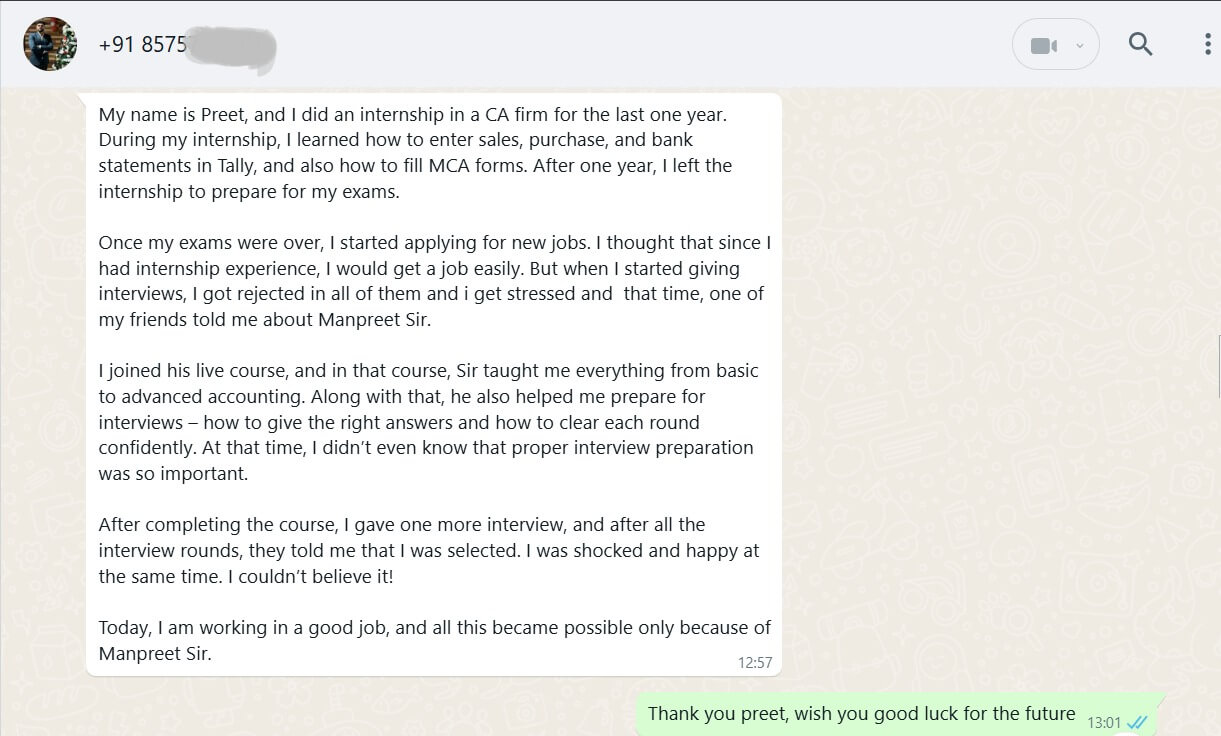

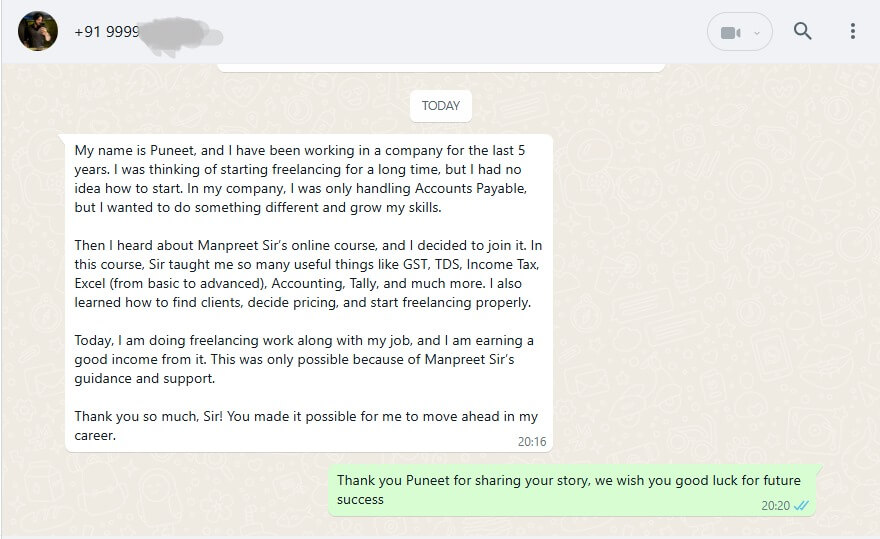

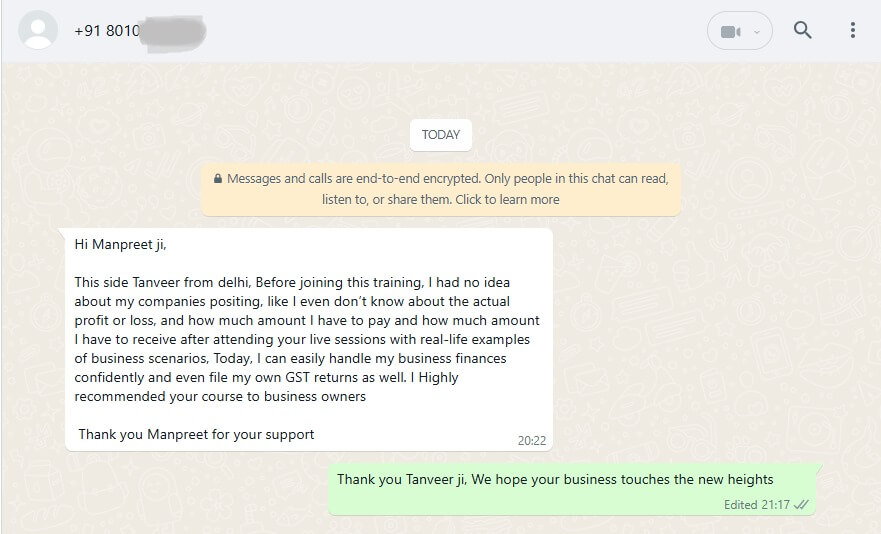

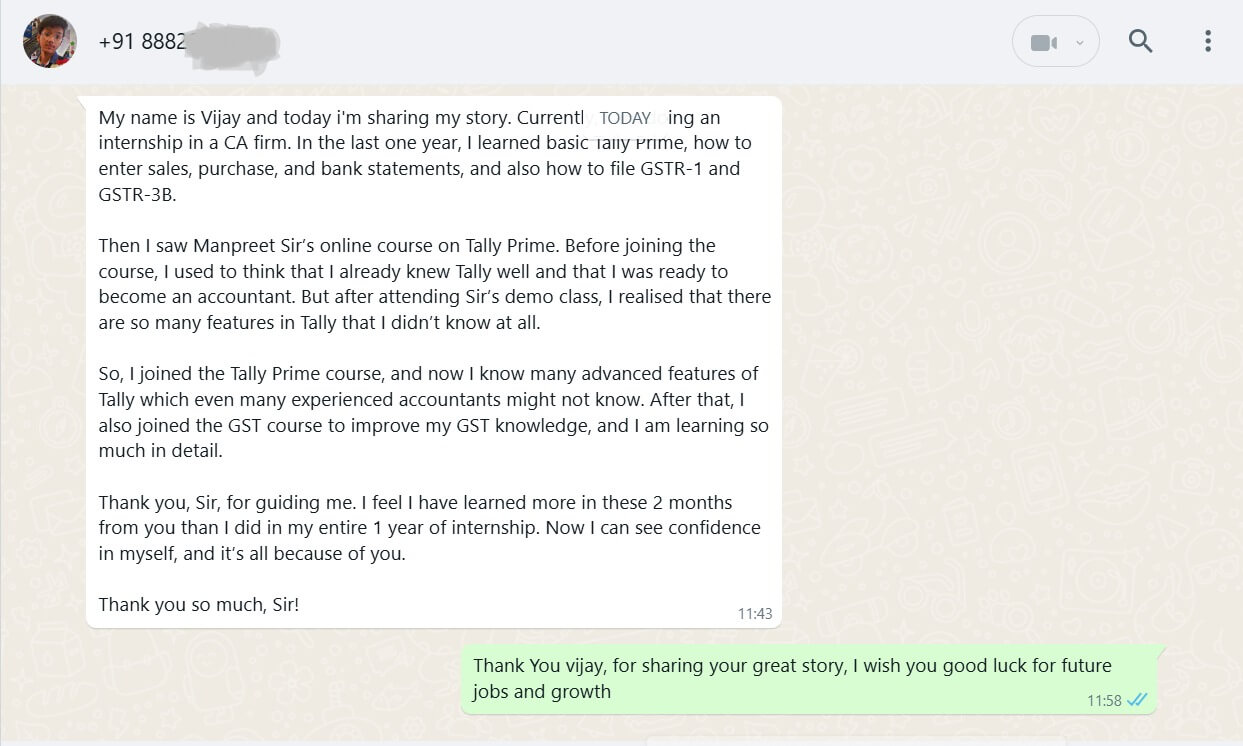

Success Stories of Our Students

Started As A Complete Beginner, These People Have Secured Seats In

The Top International Corporations!

Meet the Coach

Manpreet Singh

✅ Professional in Accounts & Taxation with having a 10+ Years of Industry Experience

✅ Having a Deep Knowledge in Tally Prime, Busy, Quickbooks, SAP

✅ Having a Deep Knowledge of GST, Income TAX, TDS & TCS

✅ Having a Deep Knowledge of Finanlisation of Books of Accounts for the Audit Purpose.

✅ Having a Deep knowledge of Preparation of Balance Sheet